Gov. Glenn Youngkin has proposed a permanent disaster relief fund to support Hurricane Helene recovery and a tax credit to relieve low- and middle-income Virginians of the car tax in his list of budget amendments to be considered in the upcoming legislative session.

The disaster relief fund would include $127 million to help residents recover and rebuild in the Southwest region and to establish a standing pot of money to support recovery after future disasters that could take place across the commonwealth.

Of that $127 million, $25 million would come from the state’s general fund and about $102 million would come from proceeds from Virginia’s participation in the Regional Greenhouse Gas Initiative, or RGGI, in 2023.

The standing fund is intended to work as a supplemental to disaster aid provided by the Federal Emergency Management Agency and localities. Virginia currently does not have state money available for disaster recovery.

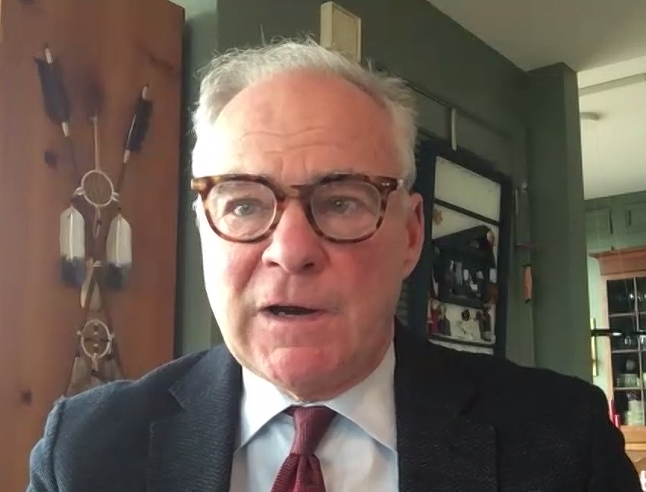

“I fully expect that the General Assembly and our administration will work constructively together in this next short session to appropriate funds specifically for Hurricane Helene relief. I know that together we can rebuild stronger than ever,” Youngkin said during his presentation to the General Assembly’s Senate and House of Delegates finance committees.

The language of Youngkin’s proposal was broad, and ultimately left the responsibility of crafting and passing legislation to establish the disaster relief fund up to the General Assembly.

Del. Will Morefield, R-Tazewell County, said that he appreciates the inclusion of disaster aid in the governor’s budget amendment proposals. The House Appropriations Committee, under Chairman Del. Luke Torian, D-Prince William County, has been working for several weeks on crafting a program that the committee hopes will provide “significant relief for property owners with the most significant damage,” Morefield said.

“It’s comforting to know the governor, Democrats and Republicans in both the House and Senate are willing to do everything they can to help the hurricane victims,” Morefield said in a text message Wednesday. “We look forward to reaching an agreement on a final package and will provide details in the coming weeks ahead as the legislative process moves forward.

“The hurricane victims can rest assured knowing that help will be on its way,” he continued.

Revisiting car tax relief

The car tax relief effort, dubbed the Working Class Car Tax Credit, would cost about $1.1 billion to pre-fund the first three years of what Youngkin intends to be a permanent rebate.

Individuals who make less than $50,000 per year could see a tax credit of $150 and joint filers who earn less than $100,000 will qualify for roughly a $300 credit, Youngkin said. On average, a family of four with one car could expect up to $290 in rebates under the program.

“It’s not a Republican idea, it’s not a Democrat idea, it’s just common sense, and therefore, let’s give Virginia families relief from the most hated tax in America since the tax on tea — the car tax,” Youngkin said.

Republican Gov. Jim Gilmore ran his 1997 campaign on a slogan of “no car tax” — which proved very popular in Northern Virginia, where car taxes are very high. Gilmore’s plan was to reimburse local governments out of the state surplus.

Critics of Gilmore’s proposal argued that surpluses come and go and that the plan represented a transfer of wealth to the most affluent localities in the state. A few rural counties didn’t even have a car tax at the time. Gilmore was able to get part of his plan enacted, in the 1998 Personal Property Tax Rebate Act, but the rest was unsuccessful.

Youngkin said that he believes part of the state government’s responsibility is to “translate the car tax relief to the localities to put a lid on how they’re increasing the car tax.” Youngkin said his administration also included a cap on the annual increase in the rate of car tax in the package of budget amendment proposals.

The importance of the personal property tax, better known as the “car tax,” to local coffers varies by locality. It accounts for 9.34% of the general fund revenues in Salem, for instance, but 20.66% in Prince Edward County, according to local officials. In Roanoke County, that tax accounts for 17.08% of general fund revenues. In Lynchburg, it makes up 10.8% of total revenues, not counting the money the state chips in under the Personal Property Tax Rebate Act. Including those state funds, the personal property tax makes up 13.2% of total revenue in Lynchburg.

Doug Stanley, Prince Edward County administrator, said localities need more information on the governor’s proposed rebate before they can determine whether the new program would affect local budgets.

The personal property tax is a critical revenue source for local governments in Virginia, he said.

“The impact of a proposed car tax credit will depend on the specifics. If the commonwealth is offsetting lost revenues for localities, that would certainly mitigate any negative effects; however, if the entire burden falls on local budgets, that could create financial challenges for Virginia’s counties, cities and towns,” Stanley said in an email. “We would either need to find alternative funding sources or make adjustments to essential public services, like education and public safety, to cope with revenue shortfalls.”

Sen. Creigh Deeds, D-Charlottesville, said he liked parts of the governor’s car tax proposal — that it is geared toward lower-income people and that it is refundable — but he is concerned about where the money will come from if the proposal is to be permanent.

“I was really excited when he said he was going to address the car tax because I thought he was going to propose a constitutional amendment to do away with it and actually come up with a substitute way for local governments to raise money,” Deeds said. “The proposal will just have to work its way through the process.”

“We’ve simply got to budget over the long haul,” he said. “We’ve got to make sure Virginia’s fiscal state is safe in the long run.”

Education, public safety, workforce readiness also get budget nods

A Youngkin adviser noted that the state garnered $4.7 billion in surplus revenue over the last few years and that the administration is using that money on which to base its budget amendment proposals.

Aside from disaster and car tax relief, the governor touted a “no tax on tips” initiative that, as its name implies, would eliminate taxes on the tips received by workers in the food service industry. That initiative, introduced by President-elect Donald Trump on a national scale during his 2024 campaign, could cost the state about $70 million per year.

Youngkin made a pitch to keep Virginia’s existing standard deduction and to make it permanent. The deduction, which is set to expire Jan. 1, 2026, is currently $8,500 for single taxpayers and $17,000 for joint filers. Youngkin said that failing to make that deduction permanent prior to 2026 would result in tax increases. The standard deduction for single filers previously had been $4,500, and $9,000 for joint filers.

The governor also proposed an increase in direct aid for K-12 education. That includes $290 million for school construction and modernization, $550 million in direct aid to schools, $6.8 million for school resource officers, $50 million for schools that have been identified as needing “the most help” based on school performance framework, $110 million for English Language Learners and a new $50 million scholarship program for low-income families to support their children’s attendance at a private school.

For higher education, Youngkin proposed a 2.5% cap on tuition increases for colleges and universities, $25 million in incremental lab school partnership funding to be put to use with historically Black colleges and universities and $120 million over two years in higher education support for family members of veterans.

To prepare the future of Virginia’s workforce, the governor included $13.9 million in funding for nursing recruitment and training programs, $35 million for high school dual enrollment and career and technical education, and $50 million in incremental funding for business-ready sites.

Regarding public safety, Youngkin proposed $35 million to employ special “conservators of the peace” who would transfer people into their custody while they are awaiting placement for health care or mental health support and $50 million to renovate, upgrade and repair behavioral health facilities.

The governor also proposed $687 million to fully fund Medicaid and associated rate forecasts and $105 million for the Children’s Services Act.

About $26 million was also proposed for agriculture best management practices to control topsoil loss and reduce the negative environmental impact of farming. About $227 million was proposed to advance technology in Virginia’s government.

Democrats respond

Senate President Pro Tempore Louise Lucas, D-Portsmouth, who chairs the Senate Finance Committee, said the committee plans to consider the governor’s proposal but, she said in a statement, the budget amendments that it plans to bring forward will look different.

“Here in the Senate, we look beyond elections and talk-show appearances and budget for the long haul,” Lucas said. “Working families are feeling the impacts of inflation, and we plan to provide more immediate relief.”

She noted that the Senate budget will provide relief to working families and individuals while investing in the education and well-being of all Virginians and maintaining the commonwealth’s fiscal health.