U.S. Sen. Jim Justice and his family companies have paid more than $56 million of their overdue loans to Martinsville-based Carter Bank, the bank said Thursday.

In mid-2023, the bank placed more than $300 million in loans personally guaranteed by Justice; his wife, Cathy; and their son, Jay, in nonaccrual status, which means the loans would not earn interest because payments weren’t being made.

With the Justices now paying down the balance, including paying $6.9 million during the first quarter of this year, the amount due stood at $245.1 million as of the end of March.

The bank said it lost out on $6.8 million in interest income in the first quarter and has missed out on $71.9 million total since mid-2023.

Carter Bank’s financials remain otherwise strong, the bank said Thursday as it reported a higher first-quarter profit of $9 million, or 39 cents per share, up from $5.8 million, or 25 cents per share, a year earlier.

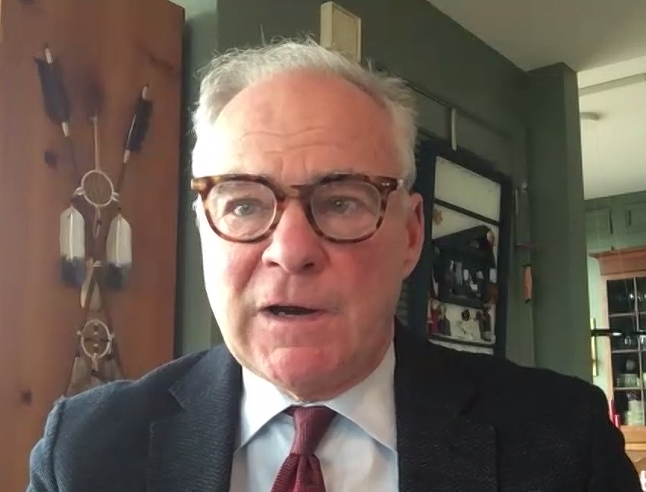

Jim Justice, a Republican, was sworn in to the U.S. Senate representing West Virginia in January after serving as that state’s governor since 2017.

The family companies operate coal, agricultural and hospitality businesses in Virginia, West Virginia and North Carolina, including The Greenbrier luxury resort in White Sulphur Springs, West Virginia.

The Justices collectively are Carter Bank’s largest borrower. Their companies previously owed the bank as much as $775 million before bringing that down to approximately $300 million in April 2023, when the loans became overdue and the bank took legal action seeking repayment.

After clashing in the courts, the bank and the companies announced in June that they had reached a settlement regarding repayment.

Carter Bank (NASDAQ:CARE) has $4.7 billion in assets and more than 60 branches in Virginia and North Carolina.