Roanoke-based Member One Federal Credit Union and Richmond-based Virginia Credit Union plan to merge, creating a combined entity with assets of nearly $6.8 billion and serving nearly 500,000 members.

The two credit unions said Thursday there are no plans to close any of their 37 combined branch locations or lay off any of their 1,100 combined employees as part of the merger, which would create the third-largest credit union in Virginia and one of the 50 largest in the U.S.

If the merger earns regulatory approval and an affirmative vote from Member One members, the entities would legally join sometime this year. Member One Federal Credit Union would be called “Member One, a division of Virginia Credit Union” or something similar, while Virginia Credit Union’s name would not change, according to a list of frequently asked questions on both credit unions’ websites.

In a news release, the organizations described the merger as occurring between “two financially healthy, future focused credit unions committed to providing unparalleled branch and digital access” and “[i]n a highly competitive financial services industry where consumers want things easier and more seamless than ever.”

“Becoming a larger organization with more locations, more talent, and more resources will ultimately result in greater economies of scale which is a good thing,” Chris Shockley, president and CEO of Virginia Credit Union, said in the release. “What becoming larger does not mean, however, is that we sacrifice our mission and our purpose. We would continue to invest in our members, our people, and our communities.”

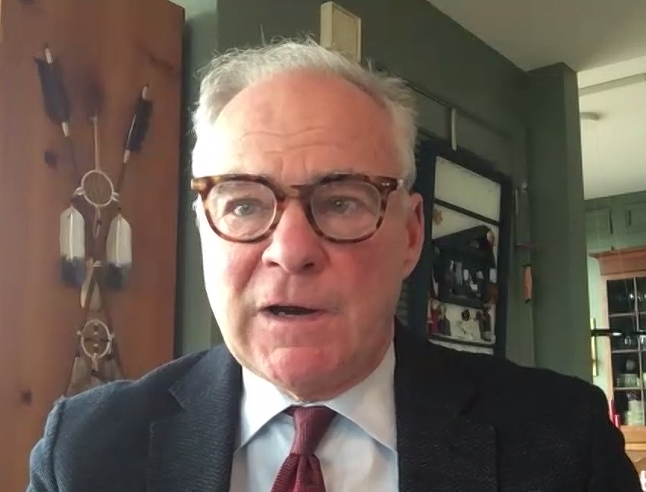

Frank Carter, president and CEO of Member One, concurred in the release, saying, “From the onset, both of our boards of directors have focused on ensuring that together we’d continue to provide the best member, employee, and community value.”

If the merger goes through, Shockley will become president and CEO of the new combined entity, while Carter will remain on as an executive until he retires, according to the news release.

Member One Federal Credit Union traces its history to 1940, when it was chartered as Norfolk & Western Credit Union for employees of the Norfolk & Western Railway, which later merged with Southern Railway to become Norfolk Southern. The credit union moved its headquarters to downtown Roanoke in 1981 and changed its name to Member One in 1996, according to its website. Today, it has 15 branches and more than $1.6 billion in assets.

Virginia Credit Union was chartered as State Employees’ Credit Union Inc. in 1928 and has since grown to more than 20 branches and about $5 billion in assets.